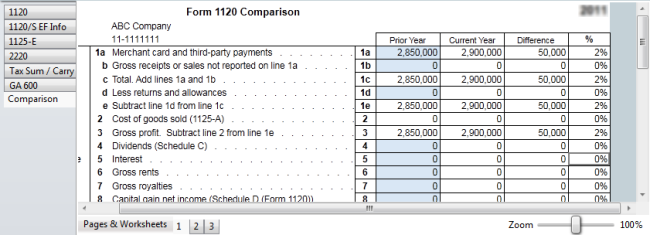

Last Year Comparison

The Last Year Comparison worksheet is a three-part worksheet that can be added to a return via the Forms menu. The Last Year Comparison compares this year's and last year's income and deductions, and the resulting percentage change.

To use the Last Year Comparison worksheet:

- Open the return.

- Click the Forms menu, expand the Planning/Analysis fly-out menu and then select Last Year Comparison.

Last Year Comparison worksheet

You can also add the Last Year Comparison worksheet to a return via the Add Forms function. In the Find field of the Select Forms Dialog Box, enter the word Comparison. Select Comparison for the return type (such as Comparison 1120), and click Open Forms. The worksheet is added to the return.

- In the Prior Year column, enter amounts from client's prior year tax return. (The Current Year amounts are from this year's forms and schedules.)

In order for the Prior Year column to contain last year's amounts, you must have included the Comparison worksheet in last year's return and have used the Rollover function.

- Be sure to review all pages of the worksheet.

See Also: